The market, operators and regulators are now unanimous in believing that diversity is one of the key elements to ensure an optimal composition and effective functioning of Boards of any organization and in any sector. A diversity that affects not only gender, but also geographical origin, professional background, age, ethnicity.

However, in the insurance sector this issue has not so far represented a specific aspect of reflection for regulatory and supervisory policies. Only very recently has the international standard setter of insurance supervision affirmed the importance of the principles of diversity, equity and inclusion for the supervisory objectives [Statement published on November 16, 2021 by the International Association of Insurance Supervisors]. Furthermore, at the European level, the Solvency II prudential framework does not deal with the issue of diversity with reference to the composition of corporate bodies, as is the case for the EU banking and investment company regulations.

IVASS has recently published a document (Quaderno n°22) signed by Diana Capone, Sara Butera and Flaminia Montemaggiori, dedicated to this issue.

The Notebook starts from an analysis of the level of diversity in the top figures of Italian insurance companies, with reference to the period 2015 - 2019.

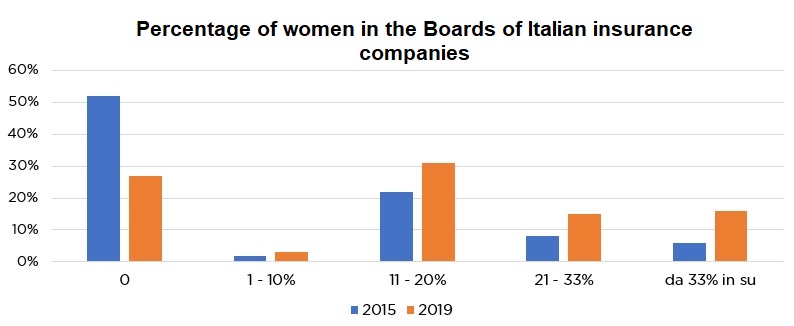

Overall, the analysis shows that the presence of women in the board of directors of companies, despite the lack of specific interventions to support gender diversity in the insurance sector, has slightly increased, probably due to the social pressure towards a more inclusive financial sector.

Against an average number of board members that remained substantially constant, the percentage of women in 2019 was on average 17%, with an increase of 7 percentage points compared to 2015. Furthermore, companies that reach or exceed the share of 33% of female presence went from 8% in 2015 to 18% in 2019.

If the representation of women in the roles of Board members improves significantly (from 13% to 21%), the same cannot be said if we consider top figures such as chairman, chief executive officer and general manager, roles in which the percentage is respectively stable (5% ), slightly higher (5% to 7%) and slightly lower (9% to 7%).

Considering only the listed Italian insurance companies (5 companies in 2015 and 4 in 2019), to which the mandatory threshold of the Gulf-Moscow Law is applied (33% in the reference period of the analysis), female percentages are much higher. In particular, the share of women was 27% in 2015 and 36% in 2019, values that replicate those legally prescribed. This difference confirms the fact that - in the absence of mandatory interventions - social pressure alone is not sufficient to push the change and does not allow for the effective resolution of chronic imbalance situations such as those that occur in unlisted companies.

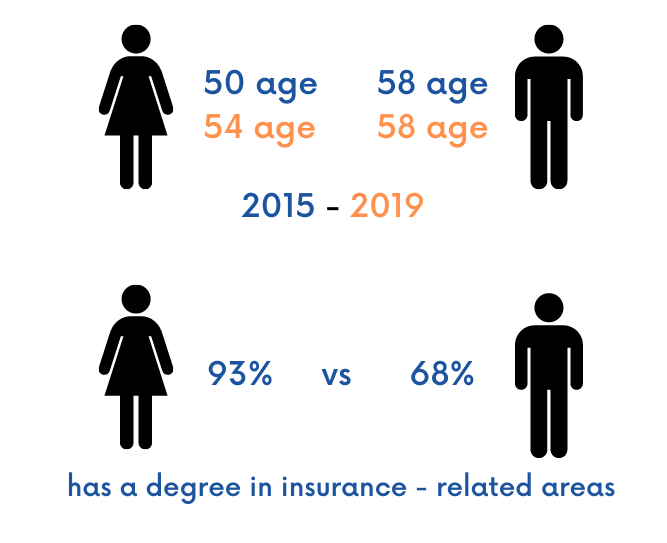

Two other factors taken into consideration by the analysis are age and training. It emerges that women on the boards are on average younger than male colleagues (50 vs 58 years in 2015, narrow gap in 2019 with respectively 54 vs 58 years) and with a higher academic preparation (93% of directors - compared to 68% of directors - has a degree in subjects relating to the activity carried out by insurance companies such as economic-financial, legal, statistical-actuarial).

Unlike what has been done in the banking sector by the European Banking Authority (EBA) and the Bank of Italy, the European Insurance and Occupational Pension Authority (EIOPA) has not so far conducted surveys on diversity in the sector and not even IVASS has published or taken specific initiatives.

This lack of attention is likely to prove to be a concrete obstacle, if we consider on the one hand the potential for business growth deriving from a greater consideration of the peculiarities of women's insurance needs and their methods of interaction - both on the side of the demand for products and services that on the offer by companies - and, on the other hand, the need to fight the phenomenon of under-insurance, so widespread in Italy, also through new strategies for involving the segments of the population traditionally less reached by the offer of products insurance companies, such as women and young people. Insufficient attention to the issue of diversity and, in particular, of the female perspective in defining business strategies risks, in fact, triggering a form of unconscious propensity to consider mainly the insurance, protection and social security needs of the male component of the population, which by default became representative of the entire sample, with an evident impoverishment of the offer and less attractiveness of the products for those with different purchasing preferences or protection needs.