Another complex year for insurance renewals is coming to an end. The hard market situation, which began towards the end of 2019 and has been worsened by the pandemic, will likely persist in 2022. However, there seem to be first signs of a reduction in pressure, and almost 60% of brokers say they are optimistic about the future of the market.

This is what emerged from Commercial Risk's Future of Risk Distribution 2021 report, which collected the opinions of 540 brokers (of which 57% independent) globally. This year was characterized not only by Covid and the hard market, but also by two important operations, with different outcomes: the incorporation of Jardine Lloyd Thompson Group by Marsh and the unfinished merger between Aon and Willis Towers Watson. Moments that have enlivened the sector and led other operators to differentiate their strategies.

Despite the fears, only 16% of the brokers interviewed claim that the tightening of underwriting conditions has worsened their relationship with customers, which has remained stable for 54% and even improved for 30%. This is because, precisely to differentiate themselves from the big names - engaged in the aforementioned operations - and to cope with the situation, many brokers have focused on the quality of the relationship with their customers.

The events of the past couple of years have sparked a new sensitivity to risk, and many brokers have worked with clients to make insurance programs an integral part of corporate risk management and resilience-building strategies, rather than being treated separately as a pure means of wealth management. This turned out, among other things, into an advantage in negotiating with insurers, who have reduced their availability and in evaluating a possible customer today carefully consider its overall exposure and risk management strategies.

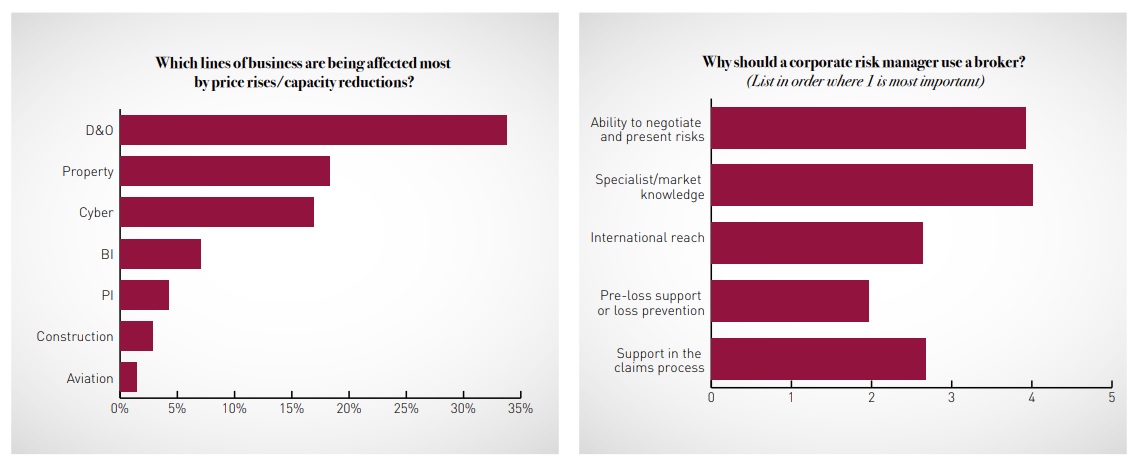

The hard market phases also reserve opportunities for brokers. Many have reported that, partly due to the need for more information for the renewals and partly because remote working has freed up time, they have been able to have much more in-depth conversations with their customers over the past year and a half. Furthermore, the hard market phases give brokers the opportunity to demonstrate their added value compared to competitors, in the ability to communicate with insurers and find solutions. Precisely on this point, the brokers interviewed indicate a need, that of having insurers respond with more appropriate timelines. This was especially true for P&C, D&O and liability renewals, the requirements of which many brokers were only able to obtain after October, often having to deal with important changes in both the capacity and the terms and conditions of the coverage.

Overall, although the difficulties related to the pandemic and the hard market have put brokers to the test in the last two years, they have also led to an improvement in the dialogue with customers, have given ideas to evolve the relationship with insurers, and have above all, it demonstrated the usefulness for companies to turn to truly qualified brokers.