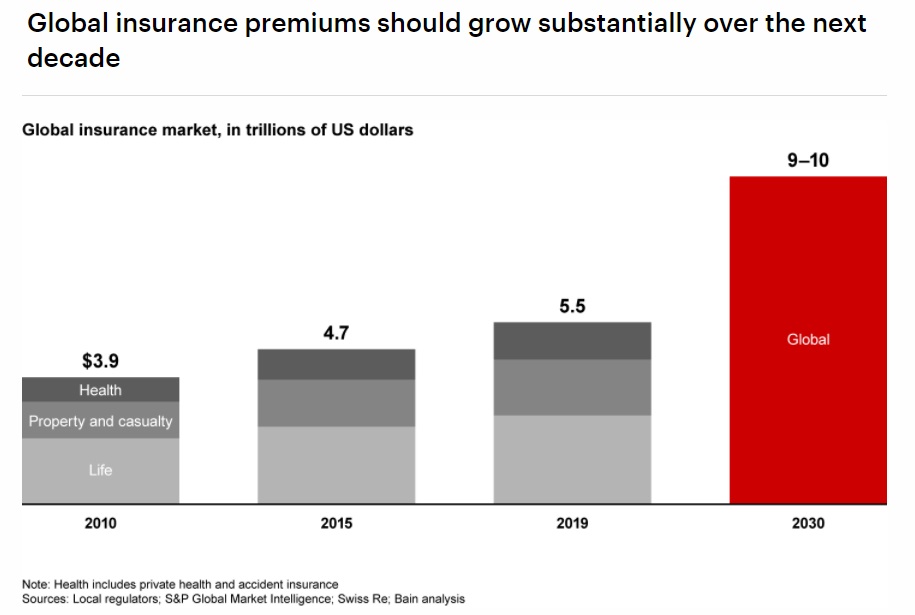

Global insurance premiums could reach $ 10 trillion by 2030, according to Bain & Company's new report "Insurance 2030: As Risks Mount, Insurers Aim to Augment Protection with Prevention".

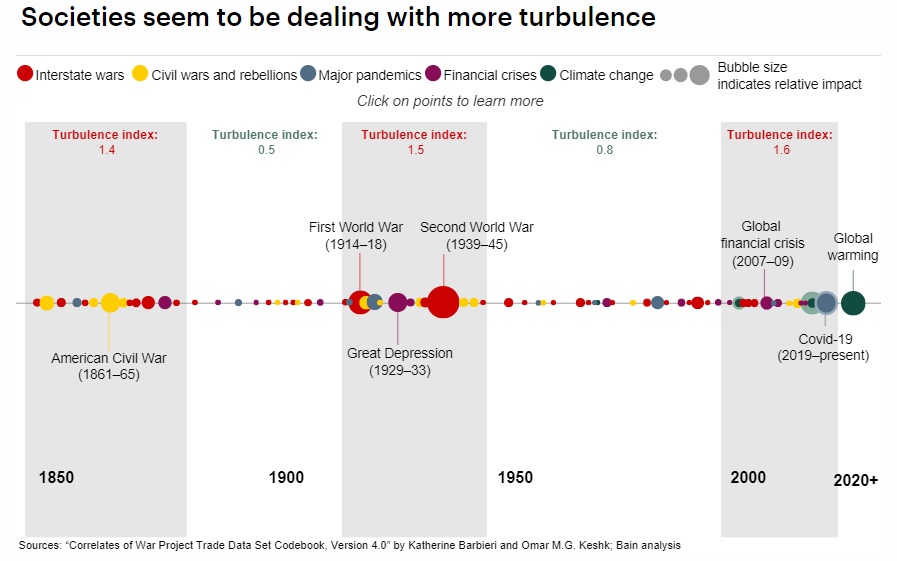

The analysis takes stock of the risks that the world will face in the coming years and the evolution of the role of insurance companies. If some more mature risks become progressively less relevant (e.g. those related to travel and commuting), others will grow in frequency and impact (e.g. cyber risks) and some risks already existing in the past will reach unexpected proportions (e.g. climate change and pandemics). These phenomena are pushing insurance companies to take on a new role, moving from "claim payers" to organizations that consider risk as a whole and encourage behavior aimed at reducing and preventing it.

While getting around is safer than ever (e.g. in the United States the death rate on roads has dropped by about 70% over the past 40 years, and similar trends are observed in Europe), Bain estimates that climate change will bring about thirty years to an approximately tenfold increase in the resulting economic losses.

The next few years will see a geographic shift in the insurance business: by 2030, China will lead over a quarter of global premium growth. However, few multinational insurance companies will benefit from the growth of the Chinese market, due to the high level of competition that exists in the country and regulations aimed at safeguarding domestic companies.

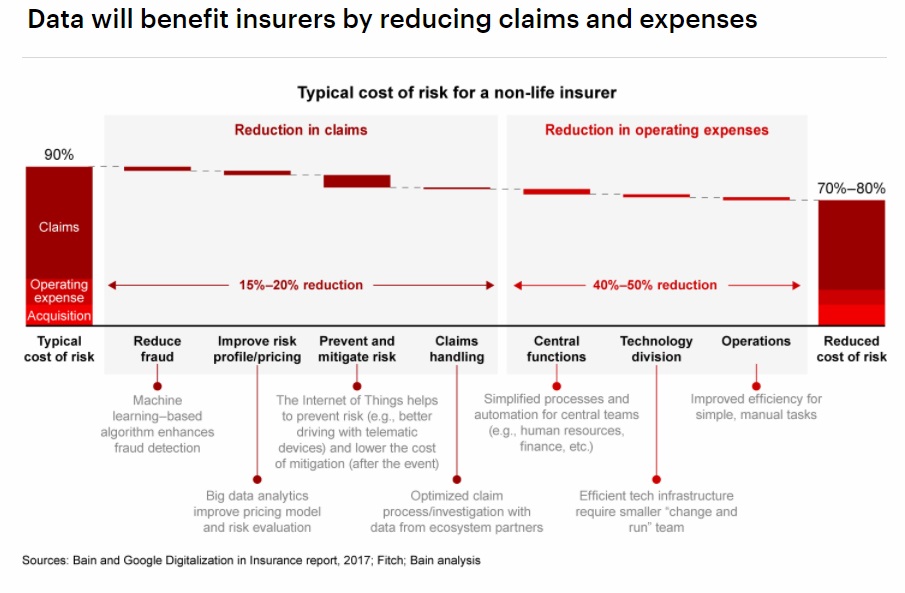

New technologies will help mitigate risks and reduce costs. Already today, insurance companies are starting to leverage automation and IoT to interact with customers. These technologies can help reduce operating costs by up to 50%, thanks to the simplification and automation of the operating model, and reduce the cost of claims by up to 20%, mitigating and preventing risks.

Competitive dynamics may lead to a decline in prices in some sectors, leading to an increase in insurance penetration and to a general growth of the sector. In parallel, however, since technology and data will make it possible to improve the ability to understand, prevent and mitigate risks in a structural way, it is probable that selectivity on the risks considered to be the worst will increase, with a consequent increase in policy prices, non-availability of specific coverages and increased regulation.

The new dynamics will lead to an evolution of the traditional value chain in the sector, questioning the current model of insurers. Encouraged by the opportunities offered by new technologies, already today many insurtechs, large technology platforms and / or leaders in other sectors, such as car manufacturers, have begun to focus on the most profitable components of the value chain with new business models.

To be successful in this new environment, insurers will need to rethink their strategy. It will be necessary to take into account the specificities of the different players and markets, but some strategic questions will be relevant to everyone: which model of interaction with customers will be most effective in preventing and mitigating risks? Different insurance coverage will be increasingly structurally integrated with the insured object, how should traditional players position themselves with respect to this phenomenon? Will they have to fight it or favor it? How will the distribution networks and direct distribution to customers evolve? Will multinational players have to increase their presence in China? If so, with which business and operational models? If not, in which other geographic areas can they be concentrated to increase growth opportunities? How proactively will insurers need to explore alternative capital options? (e.g. reinsurance, private equity, etc.)