As public sentiment has swung behind the need to do more, regulators have taken measures to encourage firms to step up, requiring them to embed climate change considerations into their risk and governance frameworks. This topic can feel rather daunting to risk professionals, as climate change touches the whole organization and interacts with many existing initiatives and activities, such as ESG goals and sustainability targets. Still, while many firms are enhancing their approaches to managing the risks of climate change, the focus has been primarily set on financial aspects and few have embedded a truly holistic and integrated strategic approach.

For many years, pioneers in the climate change domain have faced the challenge of having to invent the methods and tools needed to successfully identify and manage the risks associated with climate change, due to scarce data and limited modelling capabilities. Recently, a number of industry and academic bodies have emerged with the aim of building on researches, to help risk managers adapt their firms as the economy transitions to net-zero carbon emissions. Today, finally, slowly but surely, glimmers of good practice are emerging.

To contribute to the effort, IRM’s Climate Change Special Interest Group came together to help risk professionals navigate the complexities of climate change impacts on their organisation, by identifying and sharing best practices. These set of practices are inserted in a guide which professionals can use to identify, assess, manage, monitor and communicate the effects of climate change on their organisation. This is an important formal recognition of the importance of ESG issues to global business and the pivotal role that risk managers will have in addressing the climate crisis.

IRM has identified seven key areas requiring attention to enable the development and execution of a climate change risk management strategy in any organisation. The framework covers seven sections and is presented in the image below. We will briefly present the first two sections.

The section Climate Change Risk Landscape presents the core of the framework. Climate change is unlike any other environmental or policy problem and is characterized by a combination of unique issues such as its global and long-term nature, the fact that it is potentially irreversible and the overwhelming uncertainty surrounding its effects and progression.

Organisations must address a growing number of critical change and expectation drivers, including new international and national legislation and regulation and the voluntary disclosure approach. Other major drivers include increasing public concerns and pressure from lobby groups, activists, regulators and investors. The main change driver is the Paris Agreement from 2018, which aims to achieve Net-zero commissions & climate resilience by the year of 2050.

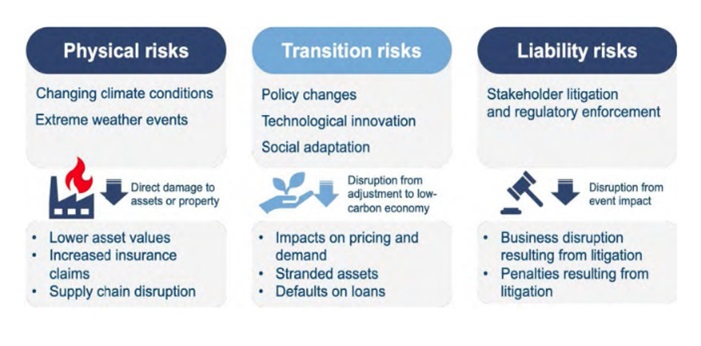

Whilst it is also important to treat climate-related risks as drivers of existing risks and map climate-related risks, it is also important to develop a taxonomy that can be discussed and used externally and internally, to ensure that all risks and opportunities are addressed and that there is a consistent approach and understanding. A new climate risk taxonomy is being adopted to provide a clear delineation of financial risks associated with climate change. The risks and their consequences are divided into Physical, Transition and Liability (Image 2).

Section 2 considers stakeholder insights and research. Stakeholder analysis is often considered the first step in strategic planning activities on an organizational level. The concept of stakeholder awareness and the need for analysis is prevalent among project management principles. Stakeholder expectations are shifting and there is a strong customer and investor focus today on corporate purpose, fulfilling regulatory requirements and pledging to meet emissions targets. It is becoming increasingly apparent that, as well as profit, ESG ratings and performance are also going to be important drivers for stakeholders including lenders, pension funds, insurers, shareholders, regulators and consumers.

The paper also suggests a Six Stage Process when building a framework, on aligning the development of climate scenario analysis within an existing ERM framework.

Organisations should carefully consider the key parameters, assumptions, and other analytical choices. Scenario analysis is not just about long-term planning but also about supporting improved business decision making in the short-term such as risk selection, pricing, reserving, risk transfer, risk appetite, etc. it is important to remember that the overall purpose of scenario analysis is to explore several plausible and ‘best-available’ ‘what-if’ scenarios, rather than to precisely forecast the future.

Finally, below are the high-level principles that firms should consider when developing their climate change risk management strategy.