Five trends will have a disruptive effect on the insurance industry over the next decade.

McKinsey described them in the report "How top tech trends will transform insurance", outlining scenarios that are anything but science fiction since the basic technologies that will guide these trends are already present today and promise to become mainstream in the coming years. The trends are applied artificial intelligence, distributed infrastructures, the future of connectivity, automation and virtualization of processes and, finally, reliable architecture.

The growing strategic nature of these technologies will bring new digital competitors to the insurance market, as demonstrated by the large number of greenfield companies born in the last three to five years. To survive, therefore, incumbents will have to adapt their operating models, distribution processes and products to the new reality.

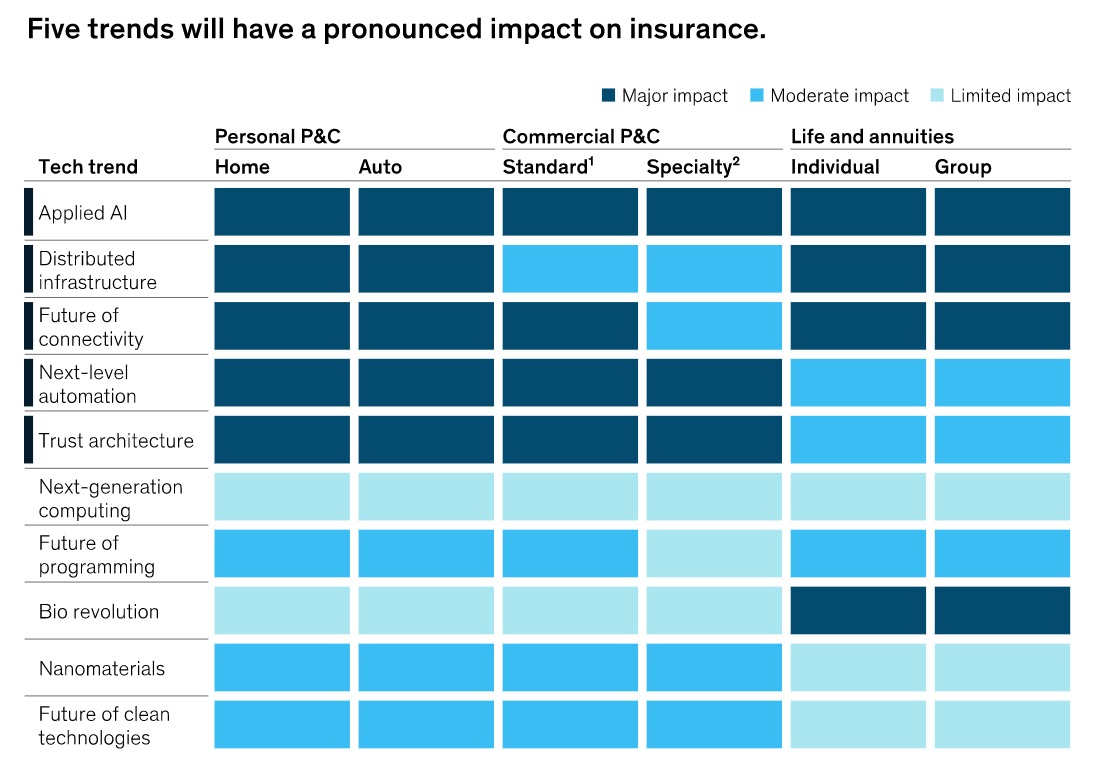

McKinsey looked at a number of factors to identify major trends. For each, a score was calculated based on the growth rate of the technologies underlying the trends, derived from an in-depth analysis of six metrics: patent filing, publications, mentions, online search trends, total private investment and number of businesses. making investments. The result is the following graph:

APPLIED ARTIFICIAL INTELLIGENCE

While many operators are already experimenting with AI, few have really scaled their capabilities across the enterprise. As artificial intelligence becomes more widespread and the creation of algorithms enters everyday life, insurance operators will be able to reform fundamental processes from a predictive perspective. Artificial intelligence will revolutionize distribution, underwriting and claims management, creating a model that will increase productivity and add value to customer relationships. Insurers have yet to fully understand the potential of the data available, such as claims histories or interactions in the distribution process. In addition to reengineering the main processes, through artificial intelligence they will be able to create new products and services by exploiting big data and analysis.

DISTRIBUTED INFRASTRUCTURE

Insurers around the world are suffering a significant technological lag, with many core processes still based on on-premise software. The move to the cloud will allow greater agility in proposing new products and the creation of better customer service, and will also allow the computing power necessary to fully exploit the data available. As new ecosystems continue to develop globally, cloud-native insurers will be in an advantageous position, acting as a connecting hub between customers, distributors, insurtechs, reinsurers.

THE FUTURE OF CONNECTIVITY

Telematics are already used in some markets, such as the automotive one. The extension of the IoT could also reshape the life, health, property and commercial lines. Increased frequency and accuracy of data shared via IoT devices helps customers provide a more accurate view of their needs and insurers better understand risk, both at underwriting and over time. The spread of 5G would allow for faster sharing of this data, helping insurers deliver services in real time.

AUTOMATION AND VIRTUALIZATION OF PROCESSES

For several years, insurers have been investing in the automation of processes, especially back-office operations, but emerging technologies will make it possible to radically rethink products and services. For example, the IoT applied in the industrial field will allow real-time monitoring of equipment and therefore to schedule maintenance before failures occur. Likewise, digital twins and 3D and 4D printing have the potential to transform claims management in all areas that affect the person.

RELIABLE ARCHITECTURE

Insurers manage a large number of sensitive information of their customers, and the evolution of products and services will lead to ever greater sharing. The new technologies will allow insurers to manage risk more effectively using such data, a fundamental step in the evolution towards an insurance model based on predictivity and prevention. As blockchains spread, they will allow to manage customer data more securely, thanks to resilient networks protected from cyber threats.

For further information, the Report is available at this link.